| Description

Locfund’s multi-product strategy seeks to serve Microfinance Institutions by offering Local Currency Loans, Subordinated Loans, Credit Line in Hard and Local Currency, Bonds Issued in Local Capital Markets, Underwriting for Capital Markets, and Market Maker Services for Fixed Income Instruments, all these complemented by providing Technical Support to the MFIs, enhancing their management capacities.

Locfund Next seeks to improve financial inclusion by solving the main limitations that slow down the growth and potential impact of Micro and Small to Medium Enterprises when it comes to providing financial services to underserved populations at the base of the socioeconomic pyramid. Its objectives focus on: (i) providing local currency financing to small and medium-sized MFIs (Tier II and Tier III); (ii) facilitating connections between MFIs and local capital markets to secure sustainable local currency financing alternatives; and (iii) supporting MFIs in modernizing their operations and expanding their outreach to clients through enhanced services, thereby facilitating their transition towards digitalization.

| Goals

LOCFUND II LP was established as an initiative of a group of investors highly committed to the development of the region, comprising:

To reach 600,000 end customers, with an indirect impact on 2.4 million people.

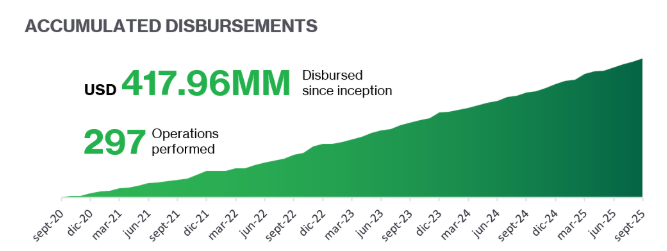

$ 820 million in disbursements.

To serve more than 114 MFIs, which represent 30% of the Latin American and Caribbean market.

Consolidating as a permanent source of financing for MFIs.

- Llegar a 600.000 clientes finales, con un impacto indirecto de 2,4 millones más de personas.

- Desembolsar 820 millones de dólares.

- Atender a más de 114 IMF, que representan el 30% del mercado de América Latina y El Caribe.

- Ser una fuente permanente de financiamiento para las IMF.

| Data as of September 2025

279.000 end clients reached with Locfund Next resources

1,98 million end clients reached through Locfund Next’s investees

60 MFIs served in 14 countries in Latin America and The Caribbean

330.000 end clients reached with Locfund Next resources

2,1 million end clients reached through Locfund Next’s investees

62 MFIs served in 13 countries in Latin America and The Caribbean

| Main Figures

| Investors and lenders

Locfund Next is the initiative of a group of investors and lenders highly committed to the development of the region, made up of:

- Norfund

- BIO

- SIFEM-Obviam

- Fundapro

- IDB Lab

- FinDev Canada

- FADES

- FMO

- DFC

- Google/Alphabet – IDB Lab

- AG – OeEB

- DEG

- MILAC Next LP

- IDB Invest

| Certifications

| Committed to SDGs